NEW DATA THIS MONTH: Q1 Retail Sales Report

TOP STORIES

|

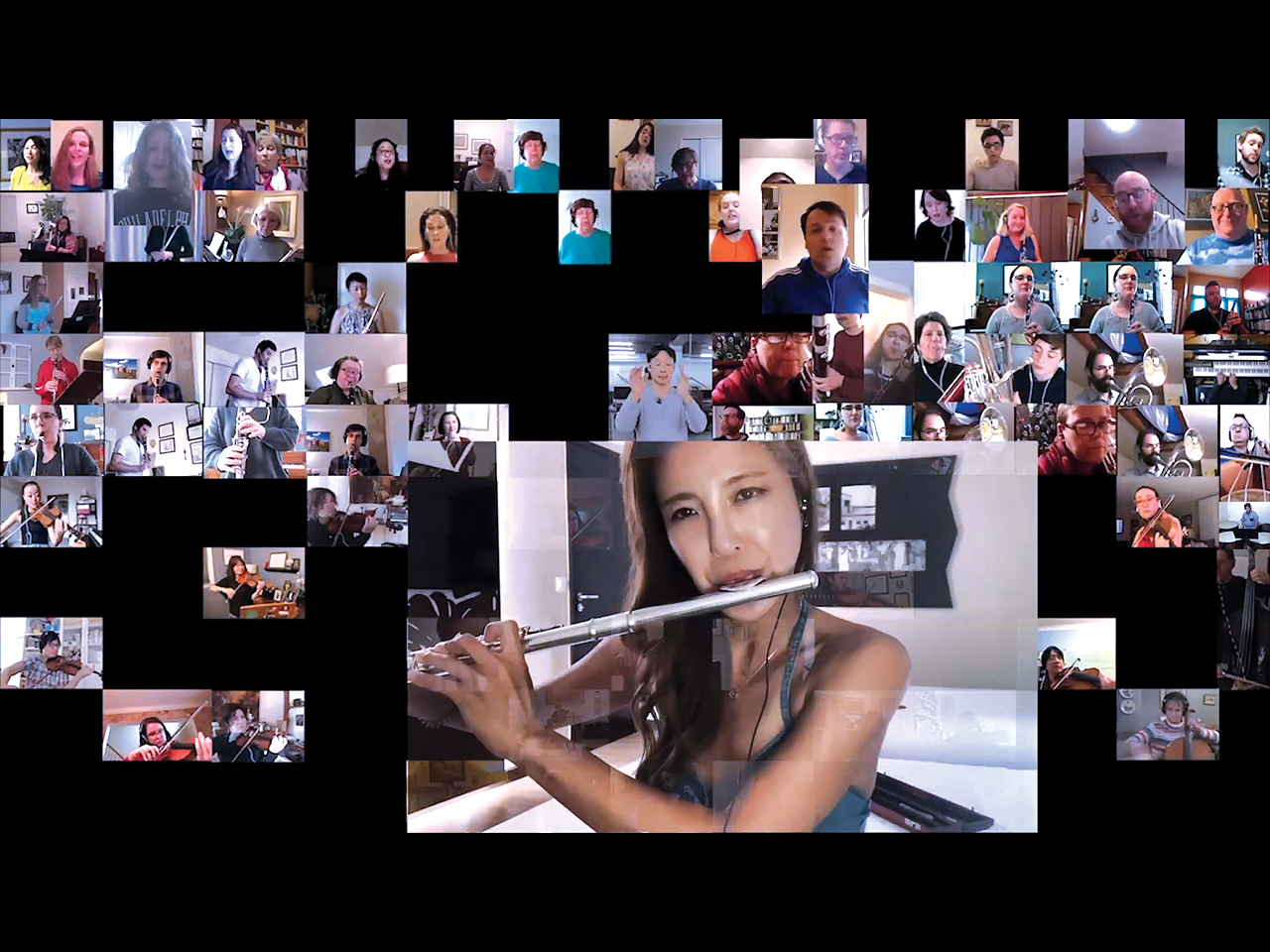

| Images of participating musicians glide together in the finished video for Cunningham’s Online Ensemble project. |

Cunningham’s ‘Online Ensemble’ Unites Locked-Down Musicians

Musicians worldwide join in an effort to make music and raise spirits—while setting a template for technology in music education.

IF YOU COULD ADD UP the combined talents of all the musicians currently stuck at home under coronavirus “social distancing” orders, you’d have one hell of an ensemble. With that in mind, the team at Philadelphia’s Cunningham Piano Company decided that’s exactly what they’d do. With its stores closed by a state order covering all nonessential businesses, Cunningham put out a call online for musicians to join a virtual performance of the Mozart motet “Ave Verum Corpus.” Within a few days, a total of 111 had responded, filling out a complete orchestra’s worth of strings, brass, and woodwind parts, plus four-part choir. The technological trick would be blending their solo performances into a synchronized whole. Working with webcam or smartphone videos submitted by each musician, Cunningham Artist In Residence Hugh Sung used a combination of audio and video editing software to layer them into harmony, bringing together musicians from 18 U.S. states and nine countries—many of whom aren’t allowed to leave their homes right now.

“We’re all in isolation,” said Sung. “But even as we’re separated, we can still make beautiful music together. It’s a message of hope. It’s a message of creativity in the face of adversity, a message that music doesn’t stop just because of a quarantine.”

"This really resonated with

our company’s mission, and that mission

is to bring the joy of music

to as many people as possible.

It’s simply our way of saying that

music is hope."

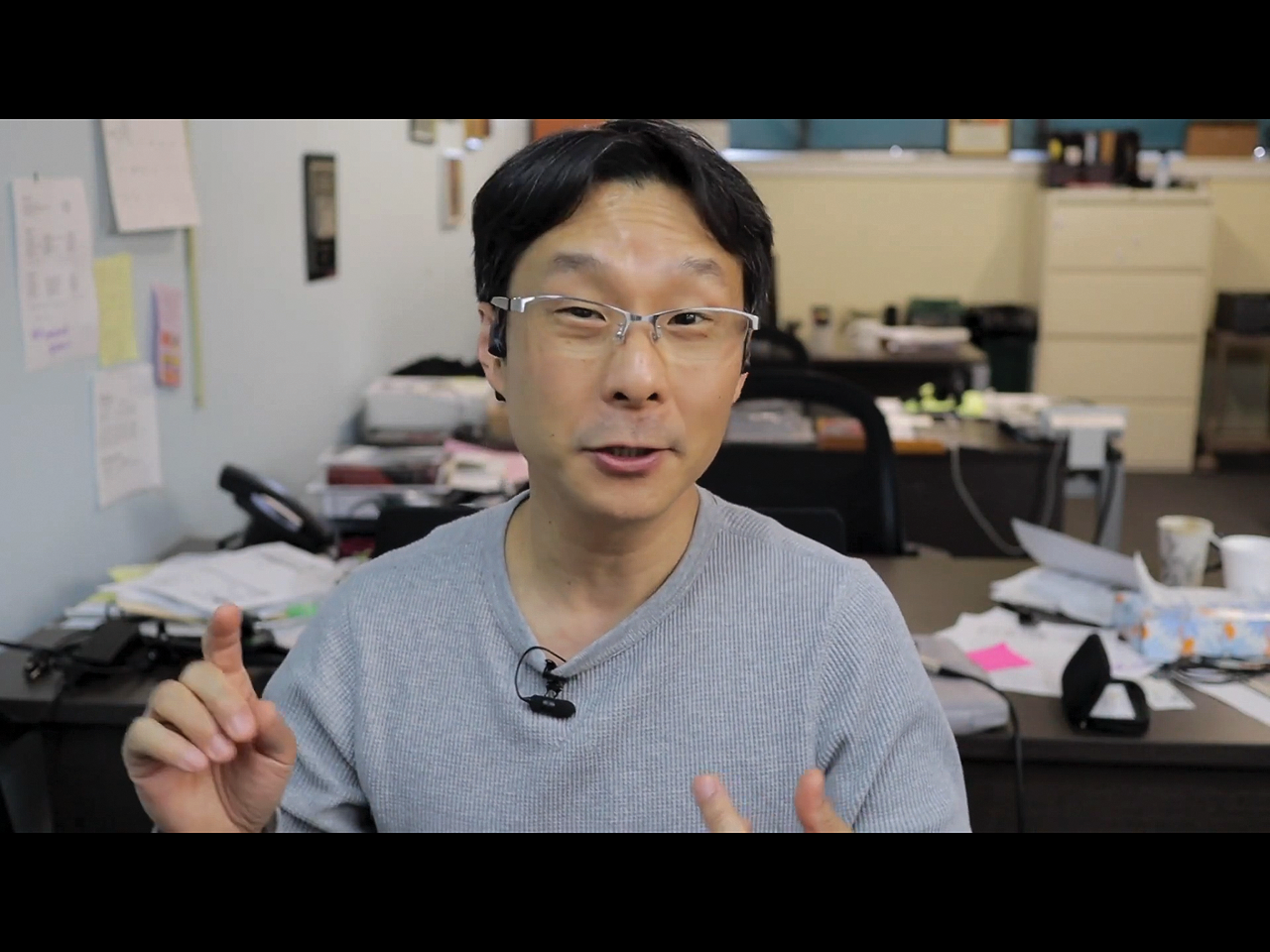

For Sung, though, Cunningham’s Online Ensemble project was also about setting a creative template for distance learning—and what he sees as an overdue update to how classical musicians think about technology. An accomplished performing pianist and educator, Sung is also known as an advocate for technology in the music world: He cofounded AirTurn, a specialist in Bluetooth technologies for digital sheet music, and has been successfully teaching on the web for more than a decade. Now in the shadow of COVID-19, with some music teachers scrambling to bring even one-on-one lessons online, he was struck by a social media post from a choir teacher who wondered how she could translate ensemble work to the web, given that her students could no longer meet in the same room. “That was my ‘aha’ moment,” said Sung.

“Technological literacy, in musical circles, needs to be addressed,” he added. “Now, there is no option but to learn these tools—you must learn them to survive. And this is one of those fun projects that can help people get up to speed very quickly.”

|

| Cunningham’s Hugh Sung recorded video tutorials to explain his process to participating musicians—as well as future groups looking to take on similar projects. |

While many efforts have been made to bring far-flung musicians into true real-time ensemble performances online, most have ultimately been limited by lag issues, Sung said. Rather than attempt that type of project, he took his cue from Grammy-winning composer/conductor Eric Whitacre’s “Virtual Choir,” an effort now comprising 8,000 singers from 120 countries. Like Whitacre, Sung would only attempt to combine his voices after the fact. To lay the groundwork, he used a Yamaha Clavinova—known for its multi-track recording tools—to lay down a MIDI backing track and voice part demos that he synchronized with videos of himself conducting the piece. (Yamaha Clavinova expert Craig Knudsen worked with the Cunningham team as a creative collaborator on the project.) Using those tracks as audiovisual aids, along with video tutorials provided by Sung, musicians were able to record their parts with the precise timing to be synced with their fellow performers later. Sung finished the project through a combination of Adobe Audition and Adobe Premiere Pro software for the audio and video editing, blending all 111 performances while converting mono audio to a full stereoscopic pan. The music was set to a visual motif where clips from each musician video glide together into a grid that later dissolves into an image of the planet earth—and the message: “We can still make beautiful music…together.”

All told, Cunningham’s Online Ensemble drew musicians from ages nine through 72. Among them were such notables as Blair Tindall, author of Mozart and the Jungle; Philadelphia Orchestra principals Daniel Matsukawa (bassoon) and Jennifer Montone (horn); renowned flutists Jasmine Choi and Mimi Stillwell; and Robert Goodlett, assistant principal contrabassist in the Indianapolis Symphony Orchestra. The finished performance video, unveiled March 30, has already inspired groups in multiple countries to try for similar projects over the length of the coronavirus lockdowns—especially if they go on long enough to interfere with summer music camps and festivals—and quite possibly beyond.

“This really resonated with our company’s mission,” said Cunningham co-owner Rich Galassini, “and that mission is to bring the joy of music to as many people as possible. From a business point of view, this is not about selling anything. It’s simply our way of saying that music is hope. And this is our hope for the future.”

The Online Ensemble video is posted at: https://youtu.be/R4YIquBE208

The leading SOURCE OF DATA & ANALYSIS SINCE 1890

© 2018 Music Trades Corporation. All Rights Reserved

Contact Us

Contact Us